Mortgage Fraud Report 2009

2009 Mortgage Fraud Report “Year in Review”

|

Scope Note The purpose of this study is to provide insight into the breadth and depth of mortgage fraud crimes perpetrated against the United States and its citizens during 2009. This report updates the 2008 Mortgage Fraud Report and addresses current mortgage fraud projections, issues, and the identification of mortgage fraud “hot spots.” The objective of this study is to provide FBI program managers with relevant data to better understand the threat, identify trends, allocate resources, and prioritize investigations. The report was requested by the Financial Crimes Section, Criminal Investigative Division (CID), and prepared by the Financial Crimes Intelligence Unit (FCIU), Directorate of Intelligence (DI). This report is based on FBI, state and local law enforcement, mortgage industry, and open-source reporting. Information was also provided by other government agencies, including the U.S. Department of Housing and Urban Development-Office of Inspector General (HUD-OIG), Federal Housing Administration (FHA), the Federal National Mortgage Association, and the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN). Industry reporting was obtained from the LexisNexis Mortgage Asset Research Institute (MARI), RealtyTrac, Inc., Mortgage Bankers Association (MBA), and Interthinx®. Some industry reporting was acquired through open sources. While the FBI has high confidence in all of these sources, some inconsistencies relative to the cataloging of statistics by some organizations are noted. For example, suspicious activity reports (SARs) are cataloged according to the year in which they are submitted and the information contained within them may describe activity that occurred in previous months or years. The geographic specificity of industry reporting varies as some companies report at the zip code level, and others by city, region, or state. Many of the statistics provided by the external sources, including FinCEN, FHA, and HUD-OIG, are captured by fiscal year; however, this report focuses on the calendar year findings. While these discrepancies have minimal impact on the overall findings stated in this report, we have noted specific instances in the text where they may affect conclusions. See Appendix A for additional information for these sources. Geospatial maps were provided by the Crime Analysis Research and Development Unit, Criminal Justice Information Services Division, and the Financial Intelligence Center, CID. |

- Law enforcement and industry reporting indicate that mortgage fraud activity––and law enforcement efforts to address it––continued to increase in 2009. FBI mortgage fraud pending investigations increased 71 percent from fiscal year (FY) 2008 to FY 2009. HUD-OIG pending investigations increased 31 percent from FY 2008 to FY 2009. Sixty-six percent of all pending FBI mortgage fraud investigations during FY 2009 involved dollar losses totaling more than $1 million. FBI mortgage fraud-related FinCEN SAR filings increased 5.1 percent from FY 2008 to FY 2009. While the total dollar loss attributed to mortgage fraud is unknown, First American CoreLogic (using mortgage loan data representing 97 percent of all U.S. properties) estimates that $14 billion in fraudulent loans were originated in 2009 ($7.5 billion in FHA loans and $6.5 billion in conforming loans).a

- A decrease in loan originations, increased unemployment, increased housing inventory, lower housing prices, and an increase in defaults and foreclosures dominated the housing market in 2009. While the economy experienced some growth in the fourth quarter of 2009 and into the first quarter of 2010, the Mortgage Bankers Association predicts that this growth will flatten or decline for the remainder of 2010 and into 2011 while rebounding in 2012. As such, the housing market is expected to remain volatile for the next couple of years. RealtyTrac reports 2.8 million foreclosures in 2009, representing a 120 percent increase in foreclosures since 2007. The Las Vegas metropolitan statistical area (MSA) reported the most significant rate of foreclosure, with more than 12 percent of its housing units receiving a foreclosure notice in 2009, followed by Cape Coral-Fort Myers, Florida (11.9 percent), and Merced, California (10.1 percent).

- Analysis of available law enforcement and industry data indicates the top states for mortgage fraud during 2009 were California, Florida, Illinois, Michigan, Arizona, Georgia, New York, Ohio, Texas, the District of Columbia, Maryland, Colorado, New Jersey, Nevada, Minnesota, Oregon, Pennsylvania, Rhode Island, Utah, and Virginia.

- Prevalent mortgage fraud schemes reported by law enforcement and industry in FY 2009 included loan origination, foreclosure rescue, builder bailout, equity skimming, short sale, home equity line of credit (HELOC), illegal property flipping, reverse mortgage fraud (currently the FHA’s Home Equity Conversion Mortgage [HECM] and the primary reverse mortgage loan product being offered by lenders and targeted by fraudsters), credit enhancement, and schemes associated with loan modifications.

- Emerging mortgage fraud schemes and trends reported by law enforcement and industry in FY 2009 included schemes associated with various economic stimulus plans/programs, commercial real estate loan fraud, short sale flops, condo conversion, property theft/fraudulent leasing of foreclosed properties, and tax-related fraud. Law enforcement sources also reported increases in gang members, organized criminal groups, and domestic extremists perpetrating mortgage fraud, and the resurgence of debt elimination/redemption schemes.

|

Mortgage Fraud Defined Source: FBI Financial Crimes Section, Financial Institution Fraud Unit, Mortgage Fraud: A Guide for Investigators, 2003. |

Mortgage fraud continued to increase in 2009 despite modest improvements in various economic sectors. While recent economic indicators report improvements in various sectors, overall indicators associated with mortgage fraud, such as foreclosures, housing prices, contracting financial markets, and tighter lending practices by financial institutions, indicate that the housing market is still in distress. In addition, the discovery of mortgage fraud via mortgage industry loan review processes, quality control measures, regulatory and industry referrals, and consumer complaints lag behind these indicators, often up to two years or more.

U.S. housing inventory increased from 127 million units to 130 million units from 2007 to 2009,1 U.S. properties in foreclosure increased more than 120 percent,2 and U.S. home prices declined each consecutive year since 2007.3 Meanwhile unemployment increased from 7.7 percent in January 2009 to 10 percent in December 2009.4 The ongoing discovery of the lack of due diligence in historical subprime loans, loan modification re-defaults,5 increasing prime fixed-rate loan delinquencies,6 and the expected increases over the next three years7 in the interest rates on Alternative A-paper (Alt-A)b and Option Adjustable Rate Mortgage(ARM)c loans raise the chance for future mortgage defaults. During the next two years, a total of $80 billion of prime and Alt-A loans and a total of $50 billion subprime loans are due to recast.8 These factors combine to fuel a mortgage fraud climate rife with opportunity. Consequently, mortgage fraud perpetrators are continuing to take advantage of the opportunities provided in a distressed housing market.

Mortgage fraud continued through 2009 despite increased government-mandated scrutiny of mortgage loan applications and institutions and recent government stimulus interventions. From 2008 through 2009, the U.S. Congress passed various stimulus packagesd aimed at stabilizing the current economic climate and releasing enormous funds into the economy, but each has potential fraud vulnerabilities. Additionally, the FBI, HUD, Federal Trade Commission, Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), and other entities have taken steps to increase mortgage fraud awareness and prevention measures, including posting mortgage fraud warnings and alerts on their websites and offering training and educational opportunities to consumers, law enforcement, regulatory, and industry partners.

Federal programs and initiatives resulting from the American Recovery and Reinvestment Act (ARRA)––including the Hope for Homeowners Program, the Home Affordable Modification Program, and the Home Price Decline Protection Program––will likely assist a majority of vulnerable homeowners with refinancing and loan modifications needed to remain in their homes. This should help to reduce the pool of potential scam victims and minimize the number of homeowners entering into foreclosure.

Additionally, other programs implemented by Congress as a result of the Emergency Economic Stabilization Act (EESA) and the Housing and Economic Recovery Act (HERA) (Congress authorized $25 million to be allocated each year from FY 2009 through 2013 to provide FHA with improved technology and processes and to help reduce mortgage fraud)9 that were designed to stimulate the economy have the potential to provide new targets for mortgage fraud activity as perpetrators vie for billions of dollars provided by these programs.10

Vulnerabilities associated with these and similar programs include the lack of transparency, accountability, oversight, and enforcement that predisposes them to fraud and abuse. These vulnerabilities could potentially lead or contribute to an increase in government, mortgage, and corporate frauds, as well as public corruption.

Several mortgage fraud schemes, especially foreclosure rescue schemes, have the potential to spread if the current distressed economic trends and associated implications continue through and beyond 2010, as expected. Increases in defaults and foreclosures, declining housing prices, and decreased housing demand place pressure on lenders, builders, and home sellers to maintain the productivity and profitability they enjoyed during the boom years. These and other market participants are perpetuating and modifying old schemes, including property flipping, builder bailouts, short sales, debt eliminations, and foreclosure rescues. Additionally, they are facilitating new schemes, including credit enhancements, property thefts, and loan modifications in response to tighter lending practices. Consequently, mortgage fraud perpetrators are continuing to take advantage of the opportunities provided in a distressed housing market. When the market is down and lending is tight, perpetrators gravitate to loan origination schemes involving fraudulent/manufactured documents. When the market is up they gravitate to inflating appraisals and equity skimming schemes. According to MARI reporting, “Collusion among insiders, employees, and consumers is highly effective in times of recession because everyone has something to gain in times of desperation.”11

Victims of mortgage fraud activity may include borrowers, mortgage industry entities, and those living in neighborhoods affected by mortgage fraud. As properties affected by mortgage fraud are sold at artificially inflated prices, properties in surrounding neighborhoods also become artificially inflated. When this occurs, property taxes also artificially increase. As unqualified homeowners begin to default on their inflated mortgages, properties go into foreclosure and neighborhoods begin to deteriorate, and surrounding properties and neighborhoods witness their home values depreciating. As this happens, legitimate homeowners find it difficult to sell their homes.

Additionally, the decline in U.S. home values has a direct correlation to state and local governments’ ability to provide resources for schools, public safety, and other necessary public services that are funded in large part from property tax revenue.12 According to the National League of Cities (NLC), the municipal sector likely faces a combined estimated shortfall of $56 to $83 billion from 2010 to 2012. The NLC expects that revenue from residential and, more recently, commercial property tax collections will see a significant decline from 2010 to 2012. City managers are responding with layoffs, furloughs, payroll deductions, delays and cancellations of capital infrastructure projects, and cuts in city services.13 According to the National Association of Realtors, local tax formulas and assessment cycles do not reflect rapid home price declines. This results in high property taxes for homeowners as median home prices continue to decline 22.3 percent from 2006 to 2009.14

The schemes most directly associated with the escalating mortgage fraud problem continue to be those defined as fraud for profit. Prominent schemes include loan origination, foreclosure rescue, builder bailout, short sale, credit enhancement, loan modification, illegal property flipping, seller assistance, bust-out, debt elimination, mortgage backed securities, real estate investment, multiple loan, assignment fee, air loan, asset rental, backwards application, reverse mortgage fraud, and equity skimming. Many of these schemes employ various techniques such as the use of straw buyers, identity theft, silent seconds, quit claims, land trusts, shell companies, fraudulent loan documents (including forged applications, settlement statements, and verification of employment, rental, occupancy, income, and deposit), double sold loans to secondary investors, leasebacks, and inflated appraisals.

Mortgage Fraud Perpetrators

Mortgage fraud perpetrators are industry insiders, including mortgage brokers, lenders, appraisers, underwriters, accountants, real estate agents, settlement attorneys, land developers, investors, builders, and bank and trust account representatives. Perpetrators are also known to recruit ethnic community members as victims and co-conspirators. FBI reporting indicates numerous ethnic groups are involved in mortgage fraud either as perpetrators or victims. This type of mortgage fraud is known as affinity fraud. Ethnic groups involved in mortgage loan origination fraud include North Korean, Russian, Bulgarian, Romanian, Lithuanian, Mexican, Polish, Middle Eastern, Chinese, and those from the former Republic of Yugoslavian States. Street gangs such as the Conservative Vice Lords, Black P. Stone Nation, New Breeds, Four Corner Hustlers, Bloods, and Outlaw Motorcycle Gang are also involved in various forms of mortgage loan origination fraud as a means to launder money from illicit drug proceeds. Additionally, African, Asian, Balkan, and Eurasian organized crime groups have also been linked to various mortgage fraud schemes.

Mortgage Fraud in a Sluggish Economy and a Distressed Housing Market

Economic Growth

The U.S. economy has experienced some growth in the fourth quarter of 2009 and into the first quarter of 2010; the Mortgage Bankers Association predicts that this growth will flatten or decline for the remainder of 2010 and into 2011 while rebounding in 2012.15 The housing market is expected to remain volatile for the next couple of years.

According to the Comptroller of the Currency and the Office of Thrift Supervision, the performance of mortgage loans serviced by the largest national banks and federally regulated thrifts declined for the seventh consecutive quarter in December 2009 though home foreclosures slowed and new home retention actions continued strong.16

According to MortgageDaily.com, bank failures doubled from 2008 to 2009. Coupled with the nearly double increase in regulatory actions against U.S. financial institutions during the same period, it is unlikely that the acceleration of bank failures will abate.17 According to the Federal Deposit Insurance Corporation (FDIC), 140 banks failed in 2009, costing the nation’s Deposit Insurance Fund $37.4 billion. As of May 31, 2010, 78 banks had failed in 2010, with the year-end total expected to exceed the 2009 rate. Although the FDIC does not make official projections, the cost is expected to be even greater in 2010 but is expected to begin to diminish in 2011.18

Unemployment

Unemployment, mortgage loan recasts, and federal loan modification efforts are factors that will influence the number of foreclosures in the next few years.19 The impact of unemployment may be difficult to capture as unemployment data are aggregated and do not capture the effects of job losses on individual households. According to the U.S. Government Accountability Office (GAO), a large number of payment-option ARMs are scheduled to recast beginning in 2010 which may result in an increase in foreclosures as these Alt-A borrowers may not be able to afford the higher payments. There is conflicting information on the true impact that unemployment is having on default and foreclosure rates. Fifty-eight percent of homeowners receiving foreclosure counseling by the National Foreclosure Mitigation Counseling (NFMC) program established by Congress listed unemployment as the main reason for default. However, the Center for Responsible Lending asserts that while unemployment compounds the current economic crisis, it is not responsible for the current increasing foreclosure rate as during previous periods of high unemployment when foreclosures remained flat.20

Negative Equity/Underwater Mortgages

At the end of fourth quarter 2009, more than 11.3 million, or 24 percent, of all residential properties with mortgages were in negative equity, meaning their mortgage balance exceeded their home’s current market value. This accounted for $801 billion with another 2.3 million properties approaching negative equity.21 Nevada, Arizona, Florida, Michigan, and California were the top five states reporting negative equity. California and Florida accounted for 41 percent of all negative equity loans. Negative equity can occur because of a decline in value, an increase in mortgage debt, or a combination of both. Negative equity makes borrowers more vulnerable to foreclosure and foreclosure rescue schemes, which can contribute to homeowners eventually defaulting on their mortgages.22

Foreclosures

National bank and federally regulated thrift servicers expect new foreclosure actions to increase in 2010 as alternatives to prevent foreclosures are exhausted and a larger number of seriously delinquent mortgages go into foreclosure.23

Home Prices

| Location | Percent Change 2008-2009 |

|---|---|

| U.S. National Index |

-2.5

|

| Metropolitan Area | |

| Las Vegas |

-20.6

|

| Tampa |

-11

|

| Detroit |

-10.3

|

| Miami |

-9.9

|

| Phoenix |

-9.2

|

| Seattle |

-7.9

|

| Chicago |

-7.2

|

| New York |

-6.3

|

| Portland |

-5.4

|

| Atlanta |

-4

|

| Figure 1: S&P/Case-Shiller Home Price Index and FiServe Data through December 2009 | |

According to the Federal Reserve, while a few districts indicated a modest improvement in their housing markets in 2009 resulting from homebuyer tax credits, low mortgage rates, and more affordable prices, overall the U.S. housing market remained depressed. This trend will continue until results of the efforts initiated by the authority of HERA and other market factors begin to stabilize the economy. U.S. residential property values fell from $21.5 trillion in 2007 to $19.1 trillion in 2008, an 11 percent decrease.24 In early 2009, U.S. home prices were at their lowest levels since May 2004 due to accelerated depreciation in 75 percent of all metropolitan markets, and housing inventory remained very high.25 According to Standard and Poors (S&P)/Case-Shiller Home Price Indices and U.S. Census estimates of total housing inventory, home prices have declined and inventory remains high in 2010.26 S&P/Case-Shiller data indicate that the Las Vegas MSA had the greatest decline in home price from 2008 to 2009 (see Figure 1). S&P/Case-Shiller, Federal Housing Finance Agency (FHFA), IHS Global Insight, and Freddie Mac forecasters indicate that house-price changes will play a key role in future mortgage performance and project declines in 2010.27 Rapid contraction in the economy in addition to deteriorating labor markets, large inventories of unsold homes, and increasing foreclosures and defaults have contributed to the continued decline in home prices in 2010.

According to First American CoreLogic, during the first 13 months of the federal housing stimulus programs, home sales and home prices stabilized. It is likely that the collective set of federal programs, including the home buyer tax credit, Federal Reserve mortgage-backed securtiy purchases, and federal foreclosure prevention programs (Home Affordable Modification Program [ HAMP], Home Affordable Refinance Program [HARP], Home Affordable Foreclosure Alternatives [HAFA]), contributed to the housing market stabilization.28 Under a simulation scenario of extended federal support, home prices are expected to increase year-over-year by more than 4 percent in February 2011. However, if the federal support ends, home prices are expected to decline by more than 4 percent year-over-year in February 2011.

Mortgage Industry

Industry participants are taking steps to increase due diligence efforts by looking more broadly and deeply at loan originations. This includes re-underwriting, fraud screening, review of closing packages, and executing a series of tolerance tests from a state and federal regulatory standpoint.29

However, regarding loan origination schemes, industry insiders allege that while credit quality is up, there is still evidence of significant error rates in the loan closures. There is also concern that new Real Estate Settlement Procedures Act (RESPA) requirements are confusing the very people who must adhere to them.

The Mortgage Bankers Association

|

|

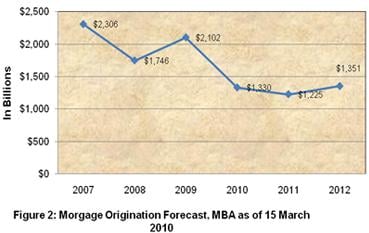

According to the MBA’s National Delinquency Survey (NDS), 10.44 percent of all residential mortgage loans in 2009 were past due. Five percent of the loans serviced were 90 days or more past due, and 9.7 percent were seriously delinquent (more than 90 days past due).30 The MBA estimates that mortgage loan originations will decrease 37 percent through 2010 (see Figure 2).31 The MBA NDS examines 85 percent of the outstanding first-lien mortgages in the market. The NDS reported 44.4 million first-lien mortgages on one- to four-unit residential properties in 2009 compared with 45.4 million in 2008. Conversely, the NDS reported a fourth-quarter increase in foreclosure rates for the same period.3233 FHA’s market share increased dramatically since FY 2007 as subprime lending decreased, lending tightened, and borrowers and lenders were looking for federally insured loans (see Figure 3).

The MBA reports an increase in foreclosure rates for all loan types (prime, subprime, FHA, and VA) from 2008 to 2009, and serious delinquencies increased 327 basis points for prime loans, 745 basis points for subprime loans, 244 basis points for FHA loans, and 130 basis points for VA loans.34

Loan Modifications

Historic increases in loss mitigation efforts, delinquencies, and foreclosures are overwhelming an already burdened mortgage servicing system.35 Loan modification fraud flourishes because of increasing demand for these loans by public and political officials, unreasonable time constraints to complete modifications, and borrowers submitting financial packages that cannot always be independently confirmed.36 Loan modification implications that may impede a lender from modifying a delinquent mortgage include specific investor guidelines, the impact on mortgage insurance, lien position, other interest parties in the property, and borrower qualifications.37 These implications also may impede borrowers from seeking or securing a loan modification and add to their frustration in dealing with lenders, which makes them more vulnerable to fraud perpetrators.38

According to the HAMP, of the more than 3 million eligible homeowners, only 230,000 have been granted permanent modifications, while 1.1 million are in trial modifications as of April 30, 2010.39 More than half of all loan modifications are re-defaulting, falling 60 or more days past due nine months after modification.40

|

|

Financial Institution Reporting of Mortgage Fraud Increases

SARs from financial institutions indicate an increase in mortgage fraud reporting.e There were 67,190 mortgage fraud-related SARs filed with FinCEN in FY 2009, a 5.1 percent increase from FY 2008 and a 44 percent increase from FY 2007 filings. SAR filings in the first six months of 2010 exceed the same period in FY 2009 by more than 4,400 (or 13 percent) (see Figure 4).f

SARs reported in FY 2009 revealed $2.8 billion in losses, an 86 percent increase from FY 2008 and a 250 percent increase from FY 2007 (see Figure 5). Additionally, SAR losses reported in the first six months of FY 2010 exceeded the same period in FY 2009 by more than $788 million (or 67 percent). While total SAR losses in FY 2009 were $2.8 billion, only 22 percent (14,737 of 67,190 SARs) reported a loss (an average of $189,862/SAR) compared with 11 percent (6,789 of 63,713 mortgage loan fraud [MLF] SARs) reporting a loss ($1.5 billion) in FY 2008 (an average of $219,619/SAR). While there was an increase in the percentage of SARs filing a loss, the average loss amount per SAR decreased from FY 2008 to FY 2009.

Top Geographical Areas for Mortgage Fraud

Methodology

Data from law enforcement and industry sources were compared and mapped to determine which areas of the country were most affected by mortgage fraud during 2009. This was accomplished by compiling the state rankings by each data source, collating by state, and then mapping the information.

Information from the FBI, HUD-OIG, FinCEN, MARI, Fannie Mae, RealtyTrac, Inc., and Interthinx indicate that the top mortgage fraud states for 2009 were California, Florida, Illinois, Michigan, Arizona, Georgia, New York, Ohio, Texas, the District of Columbia, Maryland, Colorado, New Jersey, Nevada, Minnesota, Oregon, Pennsylvania, Rhode Island, Utah, and Virginia (see Figure 6).g

|

|

Figure 6: Top Mortgage Fraud States by Multiple Indicators, 2009 |

Federal Bureau of Investigation

FBI mortgage fraud investigations totaled 2,794 in FY 2009, a 71 percent increase from FY 2008 and a 131 percent increase from FY 2007 (see Figure 7). As of April 2010, there were 3,029 pending cases. According to FBI data, 66 percent (1,842) of all pending FBI mortgage fraud investigations opened during FY 2009 (2,794) involved dollar losses totaling more than $1 million. As of April 2010, 68 percent (2,060) of all pending FBI mortgage fraud investigations involve dollar losses totaling more than $1 million.

Based on regional analysis of FBI pending mortgage fraud-related investigations as of FY 2009, the West region ranked first in mortgage fraud investigations, followed by the Southeast, North Central, Northeast, and South Central regions, respectively (see Figure 8).

FBI field divisions that ranked in the top 10 for pending investigations during FY 2009 were Tampa, Los Angeles, New York, Detroit, Portland, Washington Field, Miami, Chicago, Salt Lake City, and Dallas, respectively (see Figure 9).

FBI field divisions that ranked in the top 10 for an increase in pending investigations from FY 2008 to FY 2009 were Portland, with a 465 percent increase, followed by Tampa (363 percent), New Haven (327 percent), Jacksonville (247 percent), Omaha (230 percent), Washington Field (221 percent), Phoenix (217 percent), San Juan (200 percent)h, Seattle (181 percent), and Minneapolis (155 percent), respectively (see Figure 10).

FBI information indicates that the states of Arizona, California, Florida, Ohio, and Tennessee were consistently on the top 10 lists for property flips occurring on the same day, within 30 days, and within 60 days in 2009. Traditionally, any exchange of property that occurs on the day of sale is considered suspect for illegal property flipping. Figures 11, 12, and 13 indicate (where data was available) the number of property transactions recorded at the county clerk’s office that occurred on the same day, within 30 days, and within 60 days from the date of sale.

|

|

Figure 11: Same-Day Property Flip Transactions, 2009 |

|

|

Figure 12: 30-Day Property Flip Transactions, 2009 |

|

|

Figure 13: 60-Day Property Flip Transactions, 2009 |

According to SAR reporting, the Los Angeles, Miami, Tampa, San Francisco, Chicago, Sacramento, New York, Atlanta, Phoenix, and Memphis Divisions, respectively, were the top 10 FBI field offices impacted by mortgage fraud during FY 2009 (see Figure 14 below).

U.S. Department of Housing and Urban Development – Office of Inspector General

In FY 2009, HUD-OIG had 591 pending single family (SF) residential loan investigations, a 31 percent increase from the 451 pending during FY 2008.41 This also represented a 27 percent increase from the 466 pending during FY 2007. HUD-OIG’s top 10 mortgage fraud states based on pending investigations in FY 2009 were Illinois, California, Florida, Texas, New York, Maryland, Georgia, Colorado, Ohio, and Pennsylvania (see Figure 15).

|

|

Figure 15: Top 10 States by HUD-OIG Pending Cases, FY 2009 |

HUD-OIG data indicates that there was a 700 percent increase in the number of investigations opened in Nevadai in FY 2009, followed by New Hampshire, Florida, and Tennessee (see Figure 16 below).

|

LexisNexis Mortgage Asset Research Institute

During 2009, Florida, New York, California, Arizona, Michigan, Maryland, New Jersey, Georgia, Illinois, and Virginia were MARI’s top 10 states for reports of mortgage fraud across all originations (see Figure 17).42

|

|

Figure 17: Top 10 States by MARI, 2009 |

Florida continues to rank first in fraud reporting since 2006, and its fraud rate was almost three times the expected amount of reported mortgage fraud in 2009 for its origination volume. Virginia, Arizona, and New Jersey replaced Rhode Island, Missouri, and Colorado from 2008 reporting.

MARI indicates the top five MSAs reporting fraud in 2009 were New York City-Northern New Jersey-Long Island; Los Angeles-Riverside-Orange County, CA; Chicago-Gary-Kenosha, IL-IN-WI; Miami-Fort Lauderdale, FL; and Washington-Baltimore, DC-MD-VA. Fifty-nine percent of reported fraud in 2009 was attributed to application fraud, followed by appraisal/valuation (33 percent), and tax return/financial statement (26 percent) fraud. MARI indicates that overall, 75 percent of 2009 loans reported with appraisal fraud included some form of value inflation.43

Interthinx®

The top 10 states for possible fraudulent activity based on 2009 loan application submissions to Interthinx were Nevada, California, Arizona, Florida, Colorado, Ohio, Rhode Island, Michigan, the District of Columbia, and Maryland, respectively (see Figure 18 below).j

|

|

Figure 18: Top 10 States by Interthinx, 2009 |

Additionally, Interthinx reports that Stockton, CA; Modesto, CA; and Las Vegas-Paradise NV, were the top MSAs with the highest mortgage fraud risk (see Figure 19).k

| Rank by Mortgage Fraud Risk Index | MSA | Percent Change in Index from 2008 to 2009 |

|---|---|---|

|

1

|

Stockton, CA |

61

|

|

2

|

Modesto, CA |

66.4

|

|

3

|

Las Vegas-Paradise, NV |

41

|

|

4

|

Riverside-San Bernardino-Ontario, CA |

62.6

|

|

5

|

Merced, CA |

52.1

|

|

6

|

Reno-Sparks, NV |

44.1

|

|

7

|

Valleho-Fairfield, CA |

54.2

|

|

8

|

Bakersfield, CA |

40.2

|

|

9

|

Cape Coral-Fort Myers, FL |

44.7

|

|

10

|

Fresno, CA |

37.9

|

| Figure 19: Top 10 MSAs with Mortgage Fraud Risk per Interthinx, 2009 | ||

Fannie Mae

Loans originated in 2008 through 2009 and reviewed by Fannie Mae through December 2009 were used to formulate a geographic top 10 list by state for concentrated mortgage loan misrepresentations. Fannie Mae’s top 10 mortgage fraud states based on significant misrepresentations discovered by the loan review process through the end of December 2009 were Florida, California, New York, Georgia, Illinois, Michigan, Arizona, Texas, New Jersey, and Virginia (see Figure 20).44

|

|

Figure 20: Top 10 States by Fannie Mae, 2009 |

RealtyTrac

According to RealtyTrac, Inc., during 2009, there were more than 2.8 million U.S. properties with foreclosure filings, a 120 percent increase from 2007 to 2009.45 The top 10 states ranked by the number of foreclosure filings per housing unit were California, Florida, Arizona, Michigan, Nevada, Georgia, Ohio, Texas, and New Jersey (see Figure 21). In April 2010, one in every 386 housing units received a foreclosure filing.46

|

|

Figure 21: Top 10 States by RealtyTrac, 2009 |

Additionally, in the first quarter of 2010, foreclosures increased 16 percent over the same quarter in 2009. The Las Vegas MSA reported the most significant foreclosure problem with more than 12 percent of its housing units receiving a foreclosure notice in 2009, followed by Cape Coral-Fort Myers, Florida (11.9 percent), and Merced, California (10.1 percent) (see Figure 22).

| Rate Rank | MSA | Total Properties with Filings | Percent Housing Units (foreclosure rate) |

|---|---|---|---|

|

1

|

Las Vegas-Paradise, NV |

94,862

|

12.04

|

|

2

|

Cape Coral-Fort Myers, FL |

42,731

|

11.87

|

|

3

|

Merced, CA |

8,389

|

10.1

|

|

4

|

Riverside-San Bernardino-Ontario, CA |

126,376

|

8.8

|

|

5

|

Stockton, CA |

19,540

|

8.62

|

|

6

|

Modesto, CA |

14,812

|

8.53

|

|

7

|

Orlando-Kissimmee, FL |

72,141

|

8.17

|

|

8

|

Phoenix-Mesa-Scottsdale, AZ |

133,809

|

8.03

|

|

9

|

Port St. Lucie, FL |

15,630

|

7.58

|

|

10

|

Miami-Fort Lauderdale-Pompano Beach, FL |

172,894

|

7.16

|

|

Figure 22: RealtyTrac’s Top 10 U.S. MSA Foreclosure Markets

by Foreclosure Rate, 2009 |

|||

Prevalent mortgage fraud schemes reported by law enforcement and industry in FY 2009 include loan origination, foreclosure rescue, builder bailout, equity skimming, short sale, HELOC, illegal property flipping, reverse mortgage fraud (currently the FHA-insured HECM is the primary reverse mortgage loan product being offered by lenders and targeted by fraudsters), credit enhancement, and schemes associated with loan modifications.

Analysis of FBI domain intelligence notes, intelligence information reports, and situational intelligence reports indicate that the most common types of mortgage fraud being perpetrated throughout the United States are loan origination fraud, foreclosure rescue, builder bailout, and short sales (see Figure 23 below).

|

|

Figure 23: Most Common Types of Mortgage Fraud by FBI Field Office Territory, FY 2009 |

Fifty-one out of 56 FBI field offices report that loan origination schemes are a prevalent problem, followed by foreclosure rescue schemes (35 field offices), and builder bailout schemes (18 field offices). Based on the diversity different of schemes and techniques in a given field office territory, FBI Salt Lake City reported the most, with a variety of loan origination, builder bailout, construction loan, foreclosure rescue, equity skimming, short sale, investment, identity theft, appraisal fraud, affinity fraud, the use of straw buyers, and kickbacks at settlement schemes (see Figure 24 below).

|

|

Figure 24: Top 10 FBI Field Divisions Reporting the Greatest Variety of Mortgage Fraud Schemes, FY 2009 |

Loan Origination Schemes

Loan origination fraud schemes involve falsifying a borrower’s financial information—such as income, assets, liabilities, employment, rent, and occupancy status—to qualify the buyer, who otherwise would be ineligible, for a mortgage loan. This is done by supplying fictitious bank statements, W-2 forms, and tax return documents to the borrower’s favor. Perpetrators also employ the use of stolen identities. Specific schemes used to falsify information include asset rental, backwards application, and credit enhancement schemes.

Foreclosure Rescue Schemes—The Use of Bankruptcy Petitions

The use of bankruptcy petitions to stall the foreclosure process continues to be a prevalent threat to delinquent homeowners looking for assistance.47 Mortgage fraud perpetrators are exploiting the U.S. bankruptcy system by filing fraudulent bankruptcy petitions to delay the foreclosure process and extract the maximum profit from victims during the commission of advance fee, fractional transfer, and sale-leaseback-repurchase foreclosure rescue schemes. This type of fraudulent activity is increasing as perpetrators seize opportunities created by the current housing crisis and the more than 2.1 million properties in foreclosure.48

Builder Bailout Schemes/Condo Conversions

FBI reporting indicates that corrupt real estate developers are conducting condominium conversion bailout schemes to encourage the sale of properties by offering incentives such as cash back at closing, payments for mortgage and homeowner’s association fees, assistance with locating tenants, and property management services. However, corrupt developers are concealing these incentives from the mortgage lenders, and the properties often result in foreclosure because property management companies fail to make the mortgage payments. This significantly impacts the losses sustained by lenders who are financing the over-valued condominiums and property owners living in the surrounding neighborhoods. This fraudulent activity is a type of builder bailout scheme that is emerging nationwide with most of the activity occurring in states with high foreclosure rates, including Arizona, Florida, Illinois, and Nevada.49 Although economic conditions and the housing market appear to be improving in certain areas of the country, there will likely continue to be an oversupply of condominiums as a result of the large number of condominium conversions completed during the housing boom of the 1990s and early 2000s. Illicit condominium conversion schemes will continue to occur as real estate developers sell their excess inventory in unstable housing markets. The furtherance of this scheme will likely contribute to the increasing number of foreclosures nationwide and the decreasing value of condominium development properties.

FBI, HUD-OIG, and U.S. Treasury Department reporting indicate that reverse mortgage fraud continued to remain a high fraud concern in FY 2009 and into FY 2010.,50, 51 Unscrupulous loan officers, mortgage companies, investors, loan counselors, appraisers, builders, developers, and real estate agents are exploiting HECMs or reverse mortgages to defraud senior citizens.lm HECM-related fraud is occurring in every region of the United States, and reverse mortgage schemes have the potential to increase substantially as demand for these products rises in demographically dense senior citizen jurisdictions (see Figure 25).n They recruit seniors through local churches, investment seminars, and television, radio, billboard, and mailer advertisements, and commit the fraud primarily through equity theft, foreclosure rescue, and investment schemes.

|

|

Figure 25: Vulnerable Counties Susceptible to Potential Reverse Mortgage Fraud Schemes, U.S. Census Bureau Data |

Emerging Schemes and Techniques

As industry experts concur that there is a strong correlation between mortgage fraud and distressed real estate markets,52 the 2009 housing market remained a continuing concern for law enforcement agencies. Of particular interest are the emerging schemes reported by various law enforcement, regulatory, and industry professionals in which perpetrators are exploiting the sluggish economy and tighter lending practices implemented by financial institutions. Emerging schemes include commercial real estate loan fraud, condominium conversions, first time homebuyer tax credits, bankruptcy fraud, flopping and short sales, property theft/fraudulent leasing of foreclosed properties, tax-related fraud, and the resurgence of debt elimination/redemption schemes.

Re-emergence of Mortgage Debt Elimination Schemes by Domestic Extremists/Sovereign Citizens

Sovereign citizen domestic extremists throughout the United States are perpetrating debt elimination schemes by various means.53 Victims pay advance fees to perpetrators espousing themselves as “sovereign citizens” or “tax deniers” who promise to train them in methods to reduce or eliminate their debts. While they also target credit card debt, they are primarily targeting mortgages and commercial loans, unsecured debts, and automobile loans. Victims have been targeted in Tennessee, Mississippi, Alabama, Georgia, Florida, Virginia, California, and Nevada.54 They are involved in coaching people on how to file fraudulent liens, proof of claim, entitlement orders, and other documents to prevent foreclosure and forfeiture of property.

- A Metro-Atlanta sovereign citizen targeted unqualified borrowers in a combination foreclosure rescue, straw-buyer, and short sale scheme involving $1.2 million in fraudulent loans.55 All of the loans contained material misrepresentations of income, assets, and occupancy and were in probable foreclosure. The mortgage companies received fictitious paid-in-full notated payments. The loan payments were made in the form of fraudulent checks allegedly drawn on a UCC Trust Account and traced back to the Federal Reserve Bank of Atlanta. The perpetrator then contacted the mortgage company and attempted to negotiate a short sale of the defaulted property. Sovereign citizens reject all forms of government authority and believe they are immune from federal, state, and local laws.

Economic Stimulus: First Time Home Buyer (FTHB) Tax Credit Fraud

The schemes used to exploit the homebuyer credit program include applicants with income that exceeds program requirements, individuals who have owned a home more than five years, and individuals applying for the program before finalizing the purchase of a home. The FBI anticipates that fraud strategies will primarily include the following two deceptions: using people under the age of 18 to claim the tax credit, thereby allowing subsequent transfer of ownership to a family member who qualifies for the credit; and using non-resident aliens or illegal immigrants to apply to the homebuyer credit program. Perpetrators include first time homeowners, previous homeowners, solicitors, brokers, tax service companies, and real estate agents.

|

The First Time Homebuyer Tax Credit Source: Internal Revenue Service, First Time Homebuyer Credit, available at http://www.irs.gov/newsroom/article/0 ,,id=204671,00.html |

Some experts predict that homes sales are driven largely by the FTHB extension, according to business and real estate industry press.56 In 2009, for example, in the two months prior to the FTHB’s earlier deadline, existing home sales surged by an average of 18 percent over the levels of the three previous months, according to the National Association of Realtors.57 If the increase in new applications exceeds the earlier trend and higher numbers of applicants make it easier for the perpetrators to conceal their efforts, mortgage brokers are likely to work quickly and some, particularly unlicensed or inexperienced brokers, may overlook some necessary forms to process an individual’s tax credit quickly.

- FBI and open-source reporting indicate fraudsters are manipulating the economic stimulus program to take advantage of the first time homebuyer tax credit. The tax credit for first time home buyers is a product of the ARRA. Thousands of taxpayers have attempted to cheat the system by using their children’s information to qualify for the credit while others have recruited homeless people. According to the Internal Revenue Service (IRS), 160 schemes related to this economic stimulus tax credit have been uncovered, and it is investigating over 100,000 possible fraudulent filers in Buffalo, New York.58 The ease of electronically filing (e-filing) for the tax in 2009 made the first time home buyer tax an easy target to manipulate. E-filing for the tax credit has since been cancelled and replaced with sending in the actual documentation.

Commercial Real Estate Loan Fraud

Open sources and FBI analysis indicate that the $6.4 trillion commercial real estate (CRE) market is experiencing a high incidence of loan origination fraud similar to that seen during the last few years in the residential real estate market. Perpetrators, including loan officers, real estate developers, appraisers, and apartment management companies, are increasingly submitting fraudulent documents that misrepresent their assets and property values to qualify for loans to buy or retain property. When the loans are funded, the perpetrators often cease payment of their mortgages, resulting in foreclosure. According to open-source reporting, CRE loans are expected to produce more than $100 billion in losses by the end of 2010.59

Preliminary analysis indicates that the commercial markets exhibiting the most significant signs of distress are in areas where there is also a significant mortgage fraud problem. These areas include the New York metropolitan area, Miami, Los Angeles and Orange County, Chicago, Boston, Dallas, Fort Worth, Houston, the District of Columbia, Atlanta, and Baltimore.60

Current data indicate the potential for a significant increase in this type of loan fraud. According to the Congressional Oversight Panel (COP), the same factors that contributed to the increase in residential mortgage fraud—lax underwriting, lack of quality control, and an inflated market—are also potentially causing a significant number of commercial real estate loans to fail. Industry reporting indicates commercial real estate fraud schemes (primarily loan origination schemes), delinquency rates, SAR losses, and geographic representation mimics residential mortgage loan fraud; however, impact to the financial sector is significantly greater as bank failures begin to increase in response to failing commercial mortgage loans. According to the COP, close to 3,000 banks are currently classified as having a risky concentration of CRE loans, and all of them are small to mid-sized banks already weakened by the financial crisis. About $1.4 trillion in commercial real estate loans are due for refinancing between now and 2014, and in today’s market, many applications will be turned down, according to COP Chairwoman Elizabeth Warren. Property values have fallen 40 percent on average, and banks are unwilling to refinance; many want a lower loan-to-value ratio, which in turn will trigger numerous foreclosures. The COP indicates that the largest commercial real estate losses are projected for 2011 and beyond with bank losses reaching as high as $200 to $300 billion.

Additionally, the Congressional Research Service reported that delinquency rates for commercial mortgages increased from 4 percent at the end of the third quarter in 2009 to more than 6 percent in January 2010.61

According to commercial real estate data and analytics firm Trepp, non-performing CRE loans constituted 80 percent of the total non-performing loans for the five newly failed banks. That percentage was split almost evenly between construction and land loans (40.9 percent) and commercial mortgages (39.1 percent).

Foreclosure Rescue Schemes—Prime Fixed-Rate Loan Delinquencies

An increase in prime-rate mortgage loan delinquencies increases the risk of mortgage fraud violations. Driven by unemployment, prime fixed-rate loan delinquencies are increasing and have the potential to contribute to an increased risk in mortgage loan fraud. Mortgage loan delinquencies and related fraud activity are generally associated with higher risk subprime loan borrowers. Unlike these more vulnerable borrowers, who generally only qualify for funding with the assistance of higher risk loan products––such as Alt-A, Option ARM, and no document (doc)-low doc loans––prime loan borrowers are traditionally the more creditworthy risk for lenders. According to the MBA, prime fixed-rate loans are currently the biggest contributing factor to foreclosure rates and now account for approximately 30 percent of all new foreclosures, a 10 percent increase from 2008. According to Dominion Bond Rating Service, a credit rating agency for mortgage-backed securities, the rate of serious delinquencies of 60 or more days on underlying prime loans for the mortgage-backed securities increased 47 percent, compared to the subprime sector’s 12 percent increase. According to Fitch Ratings, “Over the next two years a total of $80 billion worth of prime and Alt-A loans are due to reset.”62 Resets, or recasts, typically have a significant negative impact on loan performance. Subsequently, this would be expected to fuel an increased risk for fraud in mortgage loans.

As there is a known correlation between mortgage loan delinquencies, defaults, foreclosures, and mortgage fraud risk, it is anticipated that the increasing number of prime rate loan delinquencies will fuel a greater pool of potential mortgage fraud victims and perpetrators. Prime rate homeowners in foreclosure will add to the growing number of foreclosure rescue victims. As foreclosures increase and the loan defaults come under review, there is increased probability that fraud will be detected in either the origination or underwriting of the loan.

Foreclosure Rescue Schemes—Loan Modification Fraud

The growing number of homeowners needing loss mitigation assistance has overwhelmed mortgage servicers and led to the explosion of third-party loan modification companies claiming to offer assistance to homeowners struggling to avoid foreclosure.63 Predatory “loan modification companies are flourishing because mortgage loan servicers cannot or will not provide borrowers with timely and consistent information regarding their requests for loan modifications.”64 Perpetrators of loan modification scams follow the same pattern as predatory lenders by targeting vulnerable homeowners, including minorities, non-English speakers, seniors, and residents of low-income neighborhoods.65

Loan modifications, typically in the form of an advance-fee/foreclosure rescue scheme, are increasing in popularity as perpetrators are taking advantage of an increasing pool of potential homeowners facing foreclosure. Individuals are perpetrating advance-fee schemes to generate income from victim homeowners. Perpetrators solicit homeowners with mail flyers offering to help them stop the foreclosure process on their homes. Homeowners are falsely told that their mortgages will be renegotiated, their monthly payments will be reduced, and delinquent loan amounts will be renegotiated to the principal. Perpetrators require an up-front fee ranging from $1,500 to $5,000 from homeowners to participate in the loan modification program. Perpetrators often request that the victim homeowners stop payments and communication with their lender. When victims receive delinquency and foreclosure notices, the perpetrators convince them that the loan was renegotiated but that the lender needs a good faith payment to secure the new account. This type of scheme is also conducted in conjunction with the filing of a bankruptcy petition to stall the foreclosure process to garner more advance fees for the perpetrator.

Home Valuation Code of Conduct Fraud

Lenders are circumventing the Home Valuation Code of Conduct (HVCC) by using other non-commission employees to order appraisals.66 The HVCC agreement between the FHFA and the New York Attorney General’s Office was intended to govern the way appraisals were ordered for all single-family mortgage loans (excluding government-insured loans such as FHA and VA) sold to Fannie Mae and Freddie Mac. In the fashion of a true arms-length transaction, all appraisals are to be ordered through a third-party appraisal management company to eliminate collusion between the appraiser and those who earn an income from loan closings (e.g., mortgage loan officers, brokers).67

Flopping, Short Sales, and Broker Price Opinions

Perpetrators are conducting short sale property flipping schemes using distressed properties of homeowners who are unemployed or facing foreclosure. The perpetrators collude with appraisers or real estate agents to undervalue the property using an appraisal or a broker price opinion to further manipulate the price down (the flop) to increase their profit margin when they later flip the property.68 They negotiate a short sale with the bank or lender, purchase the property at the reduced price and flip it to a pre-selected buyer at a much higher price.

Property Theft Targeting Bank-Owned Properties

Perpetrators are targeting bank-owned properties by filing a false warranty deed using a false rental/lease agreement and collecting advance fees from an unauthorized tenant.69 The perpetrator arranges to rent out the bank-owned property to an unsuspecting renter. If the renter is confronted by a realtor or law enforcement, the perpetrator has advised the renter to produce a lease agreement previously provided to them. During the course of this scheme, the perpetrator places “no trespassing” signs on the properties and often changes the locks.

Many local offices charged with registering property deeds, liens, satisfaction of mortgages, and various other legal documents throughout the United States do not have established methods for authenticating them.70 Recorders do not conduct due diligence to verify or otherwise determine the validity of property or other legal documents. With access to the appropriate software and knowledge of required real estate documents, a perpetrator can create fictitious documents such as a deed of trust, have the deed notarized, pay a nominal fee, and present or mail the deed to the recorder. The deed will then be recorded transferring title of all legal rights to the property.

Additional Concerns

FHA 90-Day Property Flip Waiver

The HUD FHA 90-day property flip rule designed to prevent illegal property flips of FHA-insured properties was waived by HUD through January 31, 2011 for all sellers to move a stagnant real estate market and remove property off the books and records of banks. Regulators and law enforcement officials continue to oppose this waiver as it contributes to an ever-increasing pool of potentially fraudulent property flipping schemes as it does not require the seller to have title to the property for a minimum of 90 days. Traditionally, illegal property flips take place in the span of 90 days or less.

Migration of Corrupt Subprime Lenders to Loan Modification Companies and FHA Lenders

As mortgage industry employment opportunities contract in response to the aforementioned market stressors, industry participants are migrating from subprime lending to loan modification companies and FHA lenders. There is a concern that loan modification companies and government-insured lenders are managed and/or operated by corrupt individuals or are employing those formerly involved in fraudulent subprime lending activities.71

Techniques in Response to Tighter Lending Practices

During a period wherein lenders are conducting pre-funding quality controls and increased due diligence and issuing full document loans, perpetrators are reverting to creating false documentation for loan origination. These documents, such as check stubs, W-2 forms, bank statements, verbal and written verification of income, job verification, rent verification, utility bills, tax returns, profit and loss statements, social security cards, identification cards, birth certificates, resident alien cards, and notary seals, can be manufactured and purchased through online sellers. Costs range from $15 to $1,500 with delivery in 24 hours to seven days.

As mortgage fraud crimes escalate, the burden on federal law enforcement increases. With the anticipated continued upsurge in mortgage fraud cases, the FBI created the National Mortgage Fraud Team (NMFT), fostered new and existing liaison partnerships within the mortgage industry and law enforcement, and developed new and innovative methods to detect and combat mortgage fraud.

In December 2008, the FBI established the NMFT to assist field offices in addressing the financial crisis, from the mortgage fraud problem and loan origination scams to the secondary markets and securitization. The NMFT provides tools to identify the most egregious mortgage fraud perpetrators, prioritizes investigative efforts, and provides information to evaluate resource needs. For example, the FBI began implementing the DOJ’s Strike Force Approach to mortgage fraud wherein DOJ trial attorneys were detailed to the FBI Las Vegas Field Office to collaborate with assistant United States attorneys and FBI investigative personnel in a coordinated effort to prosecute a large number of egregious mortgage fraud offenders in a short time period.

The FBI continues to support 23 mortgage fraud task forces and 67 working groups. The FBI also participates in the DOJ National Mortgage Fraud and National Bank Fraud Working Groups and the Financial Fraud Enforcement Task Force (FFETF) formed by Attorney General Eric Holder. The FFETF’s mission is to enhance the government’s effectiveness in sharing information to help prevent and combat financial fraud. The FBI actively participates in the FFETF’s Mortgage Fraud Working Group. Other task forces and working groups include, but are not limited to, representatives of the HUD-OIG, the U.S. Postal Inspection Service, the U.S. Securities and Exchange Commission, the Commodities Futures Trading Commission, the IRS, FinCEN, the FDIC, and other federal, state, and local law enforcement officers across the country. Representatives of the Office of Comptroller of the Currency, the Office of Thrift Supervision, the Executive Office of U.S. Trustees, the Federal Trade Commission, and others participate in national and ad-hoc working groups. Additionally, the Financial Intelligence Center was initiated as part of the NMFT to provided tactical analysis of intelligence data to identify offenders and emerging mortgage fraud threats.

The FBI continues to foster relationships with representatives of the mortgage industry to promote mortgage fraud awareness and share intelligence information. FBI personnel routinely participate in various mortgage industry conferences and seminars, including those sponsored by the MBA. Collaborative efforts are ongoing to educate and raise public awareness of mortgage fraud schemes with the publication of the annual Mortgage Fraud Report, the Financial Crimes Report to the Public, and press releases and through the dissemination of information jointly or between various industry and consumer organizations. Analytic products are routinely disseminated to a wide audience, including public and private sector industry partners, the intelligence community, and other federal, state, and local law enforcement agencies.

The FBI employs sophisticated investigative techniques, such as undercover operations and wiretaps, which result in the collection of valuable evidence and provide an opportunity to apprehend criminals in the commission of their crimes. This ultimately reduces the losses to individuals and financial institutions. The FBI has also established several intelligence initiatives to support mortgage fraud investigations and has improved law enforcement and industry relationships. The FBI has established methodology to proactively identify potential mortgage fraud targets using tactical analysis coupled with advanced statistical correlations and computer technologies.

The current housing market, while showing modest signs of improving, continues to suffer from high inventories, sluggish sales, and a high foreclosure rate. It remains an attractive environment for mortgage fraud perpetrators who discover methods to circumvent loopholes and gaps in the mortgage lending market whether the market is up or down. Market participants are employing and modifying old schemes, such as loan origination, short sales, property flipping, builder bailouts, seller assistance, debt elimination, reverse mortgages, foreclosure rescues, and identity theft. Additionally, they are adopting new schemes, including fraud associated with economic stimulus disbursements, credit enhancements, condominium conversions, loan modifications, and property theft—each of which is surfacing in response to tighter lending practices. These emerging fraud trends are draining lender, law enforcement, regulatory, and consumer resources.

Additionally, the distressed economy witnessed during 2009 is expected to persist through 2011, and the housing market, despite increased scrutiny of mortgage loan originations and recent government stimulus interventions, is expected to remain volatile for the same period. This will continue to provide a favorable environment for expanded mortgage fraud activity. In addition, the discovery of mortgage fraud via mortgage industry loan review processes, quality control measures, regulatory and industry referrals, and consumer complaints lags behind indicators such as foreclosures, housing prices, contracting financial markets, and the establishment of tighter mortgage lending practices, often up to two years or more, which means law enforcement may not realize a downturn in fraud reporting until 2013.

Sources

Financial Crimes Enforcement Network: Established by the U.S. Treasury Department, FinCEN’s mission is to enhance U.S. national security, deter and detect criminal activity, and safeguard financial systems from abuse by promoting transparency in the U.S. and international financial systems. In accordance with the Bank Secrecy Act, SARs, filed by various financial entities, are collected and managed by FinCEN and used in this report.

U.S. Department of Housing and Urban Development - Office of Inspector General: HUD-OIG is charged with detecting and preventing waste, fraud, and abuse in relation to various HUD programs, such as single and multi-family housing. As part of this mission, HUD-OIG investigates mortgage fraud related waste, fraud, and abuse of HUD programs and operations.

LexisNexis Mortgage Asset Research Institute: MARI maintains the Mortgage Industry Data Exchange (MIDEX) database, which contains information submitted by major mortgage lenders, agencies, and insurers describing incidents of alleged fraud and material misrepresentations. MARI also releases a report to the mortgage industry highlighting the geographical distribution of mortgage fraud based on these submissions and subsequently ranks the states based on the MARI Fraud Index (MFI), which also incorporates Home Mortgage Disclosure Act data provided by the MBA, which is a key component of calculating a state’s MFI value. The MFI is an indication of the amount of mortgage fraud discovered through MIDEX subscriber fraud investigations in various geographical areas within a particular year relative to the amount of loans originated.o

Interthinx®: The Fraud Risk Indices are calculated based on the frequency with which indicators of fraudulent activity are detected in mortgage applications processed by the Interthinx FraudGUARD® system, a leading loan-level fraud detection tool available to lenders and investors. The Interthinx Fraud Risk Indices consist of the Mortgage Fraud Risk Index, which measures the overall risk of mortgage fraud, and the Property Valuation, Identity, Occupancy and Employment/Income Indices, which measure the risk of these specific types of fraudulent activity. The Mortgage Fraud Risk Index considers 40-plus indicators of fraudulent activity, including property misvaluation; identity, occupancy and employment/income misrepresentation; non arms-length transactions; property flipping; straw-buyers; silent seconds; and concurrent closing schemes. The four type-specific indices are based on the subset of indicators that are relevant to each type of fraudulent activity. Each index is calibrated so that a value of 100 represents a nominal level of fraud risk, a value calculated from the occurrence of fraudulent indicators between 2003 and 2007 in states with low foreclosure levels. For all five indices, a high value indicates an elevated risk of mortgage fraud, and each index is linear to simplify comparison across time and location. The Interthinx Indices are leading indicators based predominantly on the analysis of current loan originations. FBI and FinCEN reports are lagging indicators because they are derived primarily from SARs, the majority of which are filed after the loans have closed. The time lag between origination and the SAR report can be several years. For this reason, the Interthinx Fraud Risk Indices’ top geographies and type-specific findings may differ from FBI and FinCEN fraud reports. The Interthinx Fraud Risk Report represents an in-depth analysis of residential mortgage fraud risk throughout the United States as indicated by the Interthinx Fraud Risk Indices. It is published quarterly, on the last day of the month following the end of quarter. As part of the Fraud Risk Report, Interthinx will report on the geographic regions with the highest Mortgage Fraud Risk Index, as well as those with the highest Property Valuation, Identity, Occupancy, and Employment/Income Fraud Risk Indices. The Interthinx Fraud Risk Indices track these risks in all states, metropolitan areas, and counties and county equivalents throughout the United States. Interthinx, Inc., a Verisk Analytics subsidiary, is a leading provider of proven risk mitigation and regulatory compliance tools for the financial services industry. Used at every point in the mortgage lifecycle to prevent mortgage fraud and compliance violations and to assess risk, Interthinx is relied upon by more than 1,100 customers, including 15 of the top 20 mortgage lenders and three of the top five largest financial institutions.

Fannie Mae: Fannie Mae is the nation’s largest mortgage investor. To aid in mortgage fraud prevention and detection, the company publishes a mortgage fraud newsletter that includes information concerning misrepresentations discovered in loan files.

RealtyTrac: RealtyTrac is the leading real estate marketplace for foreclosure properties and publishes the country’s largest most comprehensive foreclosure database with more than 1.5 million default, auction, and bank-owned homes from across the country, covering 90 percent of all U.S. households.

Mortgage Bankers Association: The Mortgage Bankers Association is the national association representing the real estate finance industry. The MBA is a good source of information for regulatory, legislative, market, and industry data.

Select Schemes Defined

Loan Origination Schemes

Mortgage loan origination schemes generally involve the falsification of a home buyer’s financial information to qualify the buyer for a loan and/or the use of a fraudulently inflated appraisal.

Falsification of Financial Information

Mortgage fraud perpetrators falsify a borrower’s financial information to qualify the buyer, who otherwise would be ineligible, for a mortgage loan. They specifically falsify the borrower’s income, assets, liabilities, employment, and occupancy status on loan documents. Additionally, perpetrators may falsify bank statements, W-2 forms, and tax return documents to the borrower’s favor. In some instances, perpetrators will also supply fictitious verification documents to be submitted with the loan package. Perpetrators also employ the use of stolen identities. Specific scams used to falsify information include asset rental, backwards application, and credit enhancement schemes.

Asset Rental Scheme

In an asset rental scheme, mortgage fraud perpetrators temporarily transfer money into an account under the name of any individual wishing to obtain a mortgage loan. The account is then used by the borrower as an asset on loan applications and can be verified by lenders for 30 days. Asset rental programs increase the ability of individuals with poor credit to obtain a loan by creating the illusion that they have significant assets.

Backwards Application Scheme

In a backwards application scheme, the mortgage fraud perpetrator fabricates the unqualified borrower’s income and assets to meet the loan’s minimum application requirements. Incomes are inflated or falsified, assets are created, credit reports are altered, and previous residences are altered to qualify the borrower for the loan.

Credit Enhancement Scheme

In a credit enhancement scheme, a mortgage fraud perpetrator artificially boosts a borrower’s credit to qualify him for a loan. This scheme may vary and may include adding seasoned lines of credit to credit histories, providing down payments to borrowers, and temporarily transferring funds to borrower accounts. This scheme helps mortgage loan applicants meet the tightened lending requirements implemented during a depressed housing market. Alternatively, fraudulent credit enhancement schemes may also be prevalent in thriving housing markets. When mortgage loan volumes escalate, quality control efforts at lending institutions are typically strained or limited. As such, mortgage fraud perpetrators may take advantage of lenders and submit fraudulent loans, hoping they will be approved with little to no industry oversight or scrutiny.

Fraudulently Inflated Appraisals

Mortgage fraud perpetrators fraudulently inflate property appraisals during the mortgage loan origination process to generate false equity that they will later abscond. Perpetrators will either falsify the appraisal document or employ a rogue appraiser as a conspirator to the scheme, who will create and attest to the inflated value of the property. Fraudulent appraisals often include overstated comparable properties to increase the value of the subject property. Fraudulent appraisals are used in illegal property flipping, assignment fee, real estate investment, and seller assistance schemes (see below) but are also used in the commission of builder bailout, HECM/reverse mortgage, foreclosure rescue, and short sales.

Illegal Property Flipping Scheme

Illegal property flipping is a complex fraud that involves the purchase and subsequent resale of property at greatly inflated prices. The key to this scheme is the fraudulent appraisal, which occurs prior to selling the property. The artificially inflated property value enables the purchaser to obtain a greater loan than would otherwise be possible. Subsequently, a buyer purchases the property at the inflated rate. The difference between what the perpetrator paid for the property and the final purchase price of the home is the perpetrator’s profit.

Assignment Fee Scheme

Mortgage fraud perpetrators use assignment fee schemes to disclose and divert illegal profits generated from mortgage loan fraud activity. An assignment is the transfer of ownership, rights, or interest in a property. Perpetrators are using fees associated with assignments, or assignment fees, to disclose and divert illegally gained proceeds on a settlement statement. Using assignment fees to divert profits is attractive because perpetrators can avoid listing their names on mortgage loan documentation. Assignment fee fraud schemes normally encompass fraudulent property sales involving inflated appraisals, falsified loan applications, and other fraudulent documents in furtherance of illegal loan fraud activity. This fraud scheme provides a viable alternative to the classic property flip and eliminates the red flag associated with properties that have changed hands in a relatively short period of time. As assignment fees eradicate the need for perpetrators to purchase properties for quick resale, their use may increase throughout the country.

Real Estate Investment Scheme

In a real estate investment scheme, mortgage fraud perpetrators persuade investors or borrowers to purchase investment properties at fraudulently inflated values. Borrowers are persuaded to purchase rental properties or land under the guise of quick appreciation. Victim borrowers pay artificially inflated prices for these investment properties and, as a result, experience a personal financial loss when the true value is later discovered.

Seller Assistance Scheme

In a seller assistance scam, a perpetrator solicits an anxious seller or his realtor and offers to find a property buyer. The mortgage fraud perpetrator negotiates the amount that the property seller is willing to accept for the home. The perpetrator then hires an appraiser to inflate the property’s value. The property is sold at the inflated rate to a buyer who is recruited by the perpetrator. The buyer takes out a mortgage for the inflated amount. The seller then receives the asking price for the home, and the perpetrator pockets a “servicing fee,” which is the difference between the home’s market value and the fraudulently inflated value. When the mortgage defaults, the lender forecloses on the house but is unable to sell it for the amount owed as a result of the inflated value.

Builder Bailout Schemes

Builders are employing builder bailout schemes to offset losses, and circumvent excessive debt and potential bankruptcy as home sales suffer from escalating foreclosures, rising inventory, and declining demand. Builder bailout schemes are common in any distressed real estate market and typically consist of builders offering excessive incentives to buyers, which are not disclosed on the mortgage loan documents. Builder bailout schemes often occur when a builder or developer experiences difficulty selling their inventory and uses fraudulent means to unload it. In a common scenario, the builder has difficulty selling property and offers an incentive of a mortgage with no down payment. For example, a builder wishes to sell a property for $200,000. He inflates the value of the property to $240,000 and finds a buyer. The lender funds a mortgage loan of $200,000 believing that $40,000 was paid to the builder, thus creating home equity. However, the lender is actually funding 100 percent of the home’s value. The builder acquires $200,000 from the sale of the home, pays off his building costs, forgives the buyer’s $40,000 down payment, and keeps any profits. If the home forecloses, the lender has no equity in the home and must pay foreclosure expenses.

Home Equity Line of Credit (HELOC) Schemes

Mortgage fraud perpetrators are exploiting HELOCs to defraud lenders. A HELOC is a credit line offered by banks, savings and loans, brokerage firms, credit unions, and other mortgage lenders that allows homeowners to access the built-up equity in their homes. HELOCs differ from standard home equity loans because the homeowner may borrow against the line of credit over a period of time using a checkbook or credit card. HELOCs are aggressively marketed by lenders as an easy, fast, and inexpensive means to obtain funds. These funds are normally withdrawn on an as-needed basis, but fraud perpetrators withdraw the entire amount within a short period of time. Two of the more common HELOC schemes are the check fraud bust-out scheme and the double-funded loan/multiple loan scheme.

HELOC Bust-out Scheme

In a check fraud bust-out scheme, a mortgage fraud perpetrator secures a line of credit and withdraws the entire allotted amount. A fraudulent check is then used to pay the balance owed on the line of credit. However, the perpetrator quickly withdraws the check amount from the line of credit before the bank realizes the check is worthless. When the check is returned for insufficient funds, the line of credit surpasses its maximum limit and the lender experiences a loss.

HELOC/Double-Funded Loan/Multiple Loan Scheme

A double-funded or multiple loan scheme occurs when loan originators require the borrower to sign multiple copies of the same loan document, which is then fraudulently submitted to several lending institutions. Often, the loan originator alters or forges the closing documents. The single loan package is then accepted and funded by multiple lenders, and the loan originator absconds with excess proceeds. For example, the multiple-funding scheme is the most common method used to exploit HELOCs. Perpetrators or criminal groups apply for multiple HELOCs to different lending institutions for a single property within a short time period. Prior to providing the funding, lenders conduct searches to determine if the property is encumbered by a lien. However, liens on a property may not be recorded for several days or months and thus cannot be immediately verified. Consequently, lenders do not discover that they hold a third, fourth, or fifth lien on a property (rather than the expected second lien) until later. The money obtained from the multiple HELOC totals more than the original property purchase price, exceeding the out-of-pocket expenses incurred to secure the property.

Home Equity Conversion Mortgage (HECM)/Reverse Mortgage Schemes